Add Garnishment Deduction and Link Payee on the Employee Profile

First, you must view the Payroll Profile page, click the Employee Maintenance list from the CertiPay home page, and select Payroll Profile. The Payroll Profile page is displayed, accessing the payroll profile of the last employee you viewed.

To find an employee, click the Find Employee link to open the Employee Lookup window. Locate the employee, and double-click the name to open it on the Payroll Profile page.

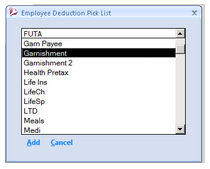

From the Deductions page, click the Add link.

Select the desired garnishment deduction (Garnishment or Garnishment 2), and click Add to add it to the Deductions table. Ensure that the garnishment deduction is selected and update the following attribute values:

|

Disposable Income % |

Enter the percentage, as a decimal number, stated on the garnishment notice. CertiPay automatically converts this number to a percentage. For example, CertiPay will convert a value of 0.50 to 50%. Note: Due to garnishment rules and regulations, CertiPay recommends that you enter a percentage for this attribute, even if the garnishment notice requests a flat amount deduction. If you choose to enter a flat amount, populate the attribute with a value of 100%. |

|

Flat Amount |

Enter the per-pay period amount to be deducted from the employee's pay check. If the garnishment is a percentage, populate the attribute with a value of 0. |

|

Garnishment Type |

Click the drop-down list and select the garnishment type:

|

|

Gross % |

If Other is selected as the Garnishment Type, enter the percentage, as a decimal number, stated on the garnishment notice. CertiPay automatically converts this number to a percentage. For example, CertiPay will convert a value of 0.50 to 50%. Otherwise, populate the attribute with a value of 0. |

|

Exempt Amount (Fed/State Levy, Other) |

Enter the wage amount that is exempt from the garnishment. If this is not applicable, populate the attribute with a value of 0. |

|

Payee Check |

Select Yes. |

|

Payee Court Code |

Click the drop-down list and select the garnishment case number. |

|

Priority |

If the employee has multiple garnishments, set the priority of which garnishment is to be deducted first. |

|

Total Garnishment Owe |

Enter the total goal amount of the garnishment. If this is not applicable, populate the attribute with a value of 0. |

When finished, click Close.